Original author: Joel John

Original compilation: Deep Tide TechFlow

A bear market is a good time to consider a career in cryptocurrencies. Working in a 24/7 industry has social, mental and physical costs.

Because of the way tokens work, the definition of a "successful" founder in the blockchain ecosystem is slightly different than it used to be in the traditional world.

You may often see founders with no product, user or business model making incredible amounts of money for themselves and their investors - based entirely on hype.

In the crypto industry, you don't need traction, sticky users, or revenue to run a "billion dollar protocol", and many so-called significant "successes" don't make any meaningful difference to the lives of those outside the industry.

Whenever regulators try to create laws around technology, it speaks to the field becoming a focus, especially in emerging markets.

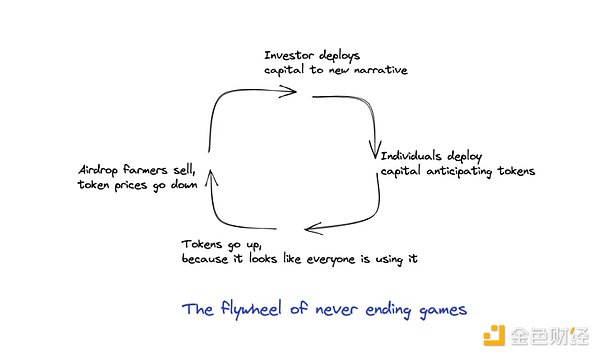

I can say that our industry is a case of Peter Pan Syndrome: a person grows up with an adult body but a child's mind. It describes a dilemma: even though the technology of the games we play is often naive to founders, investors and users, as long as there is capital to make money from these games, there will be players and the games will continue go down.

But to get to the level of Coinbase, FTX and Binance, it will take years of hard work by different capital parties.

Consumer-facing mobile apps have been the biggest driver of growth in the industry over the past five years, which explains why Wyre and Moonpay are valued at $1.5 billion and $3.4 billion, respectively. Because they are the critical infrastructure for apps to penetrate retail users through microtransactions, mostly via mobile devices.

If cryptocurrency has to want to come out of Peter Pan Syndrome, it has to reach ordinary people who don't want to care about private keys and protocols , and the way we unlock the next trillions of value is by caring about what people outside of Twitter think what do you want.

This post is an initial exploration of motivations, macro trends, and opportunities that likewise founders established in the industry can take advantage of. Against this background, let's talk in depth.

Why choose PC?

To understand why most of today's Web3 applications are PC-oriented, we can recall that most of the users who remain in cryptocurrencies today probably entered the market between 2017 and 2019. About $25 billion in funds flowed to more than 8,000 ICOs in that era. It was a golden age when anyone could trade and make quick money. But as with most trading, your advantage depends on how quickly you can get information.

In those days, the user experience that ordinary people got into the space revolved around the ICO and then hoping it would go public in a large enough multiple. Once a token is listed, you look for the next ICO to deploy the funds. This is very different from before 2017, when you could only make transactions (send/receive) or trade digital assets. That's when wallets like Myetherwallet and Metamask started to take the industry's pie.

As the DeFi ecosystem eventually evolved into the behemoth it is today, desktop-based applications became the standard by which users interacted with the industry.

In my opinion, there are two reasons for this:

-

First, before deploying funds from large institutions to DeFi protocols to accumulate TVL, a secure infrastructure is required . While this is usually only possible through browser-based wallets like Metamask, smart contract interactions and adding new tokens are much easier to do through a desktop-based interface.

-

Second, the flywheel incentivizes developers to build for the few users with the majority of capital. Products can de-emphasize the end-user experience as their main focus is to absorb as much TVL as possible. Unfortunately, this also means that most users entering the ecosystem will not have access to these new DeFi foundations for most of 2020.

Why switch to mobile facilities?

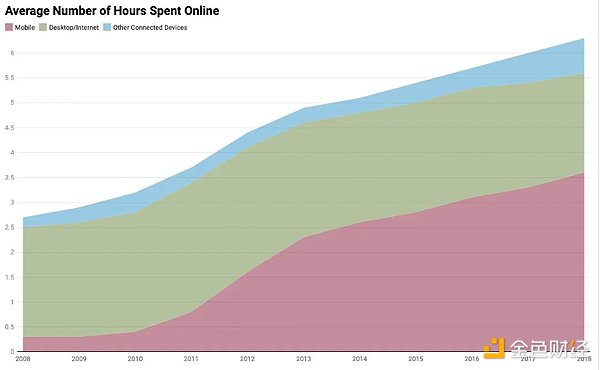

I see mobile devices as a vehicle for Web3 applications because I think it's the device that captures the most human attention. Even when we use devices like TVs — which are attention-grabbing devices by design — smartphones have an edge. It's our interface to education, dating, entertainment, shopping for groceries, paying bills, and finding new ways in which disgust exists. By 2013, the time spent surfing the Internet on mobile devices exceeded the time we spent surfing the Internet on our laptops or desktops.

Building on mobile also enables ownership elements to be experienced by people who have had little or no access to them in the past. Mobile-first applications accelerate digitization, compress costs, and make services affordable to more people.

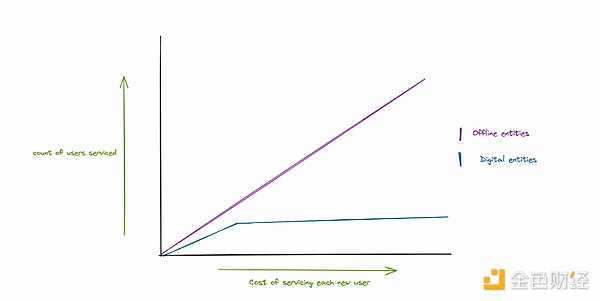

In the past, acquiring complex financial products and realizing ownership was a high-cost, low-margin product. This explains why banking the unbanked has historically been a huge problem. Employee hours scale linearly, while customer base scales exponentially. Serving a growing user base without digitization takes a lot of time, so banks do the screening.

Traditionally, for one lender, loans are made to 10,000 users — which means hiring credit assessors on a pro-rata basis. When digital banking emerged, AML/KYC and distribution capabilities increased exponentially, reducing the time spent on it - allowing digital platforms to scale with smaller teams. As the user base grows, so does the cost of servicing each new user.

Taking Compound and Aave as an example, since the smart contract runs on Ethereum, the cost incurred will be lower. DAOs do not run the infrastructure itself (the underlying blockchain). This does not include the fact that their credit assessment or AML/KYC costs are zero.

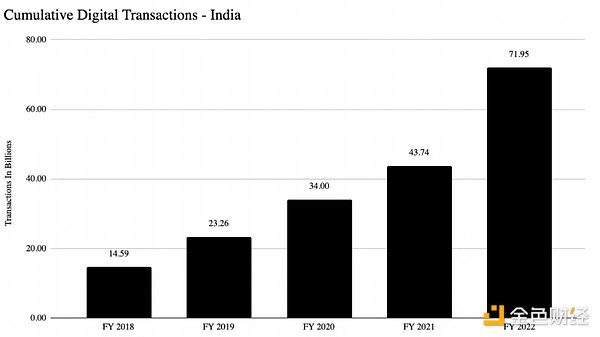

Digital banking disrupts inclusive unit economics. Suddenly, banks no longer needed to have offices in remote parts of the world. Instead, they can reach their users, perform the necessary KYC and provide banking services through a mobile device connection. This is most evident in India. A state-owned payments network in the region called UPI has expanded from $4 billion in monthly transactions to more than $120 billion in four years, with Indians conducting 72 billion transactions digitally each year.

DeFi promises to make investment bank-grade products accessible to everyone. This is a variation on the promise of ICOs, where the idea was that now everyone can invest in early-stage projects. In general - this is true, but it rules out the fact that people tend to want simplicity, set it and forget it, not those that require constant monitoring. I have an example to demonstrate this, and that is the JarHQ case from India. The app is consistently ranked in the top 20 in the region by UPI transaction volume, why do users make so many transactions? To buy gold, prices are as low as $0.05.

Historically, buying gold in India was a tyrannical act, where people spent enough money to buy much less. Jar flipped its unit economics upside down, by focusing on digital gold depositories they reduced the amount of money needed to buy gold and people flocked in a way most of their traditional, store-first counterparts couldn't speed of expansion.

How does all this translate to DeFi? From what I understand, most founders have turned to building products for institutions. Why? Because you can just focus on a few customers and claim billions of TVLs without caring about the user experience. Since your customer base is almost exclusively experienced financial managers, it also doesn't take much effort to improve user education.

This makes some business sense, since the vast majority of the volume comes from desktop users. On the other hand, the exchange sees that close to 90% of its user base is accessed through mobile applications. At the heart of building on desktop versus mobile is this struggle between the magnitude of capital and the share of people's minds.

Mapping User Motivations

I would love to learn more about user motivations and wallet user behavior patterns in emerging markets. Ravindra from Frontier Wallet was kind enough to provide information he observed on his product. Frontier Wallet is one of the first smart contract-based wallets on the market, allowing users to easily track their portfolios on multiple blockchains without interacting with each chain's browser.

Ravindra observed that Frontier’s users, who are more knowledgeable about cryptocurrencies than the average user who stores their assets on the exchange, save an average of $1,000 to $10,000. The average user of an Indian exchange has a wallet balance of close to $150 to $200. These users interact directly with multiple smart contracts and are interested in generating dollar-denominated revenue. In inflationary regions like Turkey (one of Frontier's larger markets), there is a lot of interest in being able to store digital dollars and generate yields.

He has seen different subsets of users seeking to use Web3 as a consumption track, these users typically interacting with music or gaming related NFTs on-chain. In his opinion, the next wave of digital asset users will not come to speculate on the chain, but for entertainment.

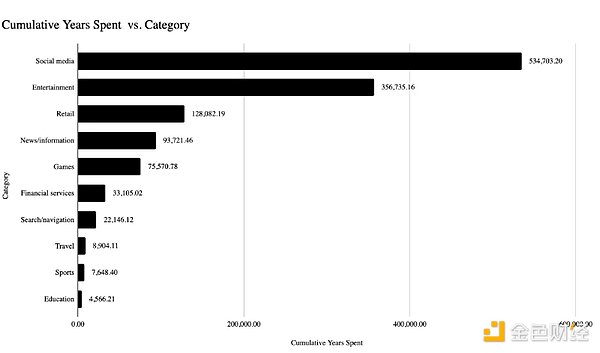

In my opinion, the arc of user growth in digital assets will follow a pattern very similar to what we have witnessed in digital consumption in India. The data above reveals how many years Indians spend in a given year consuming different app categories. Social media and entertainment are passive apps and they find the most users.

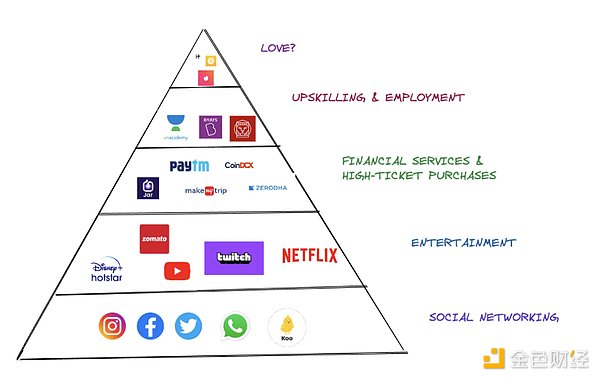

Consumption patterns follow Maslov's hierarchy almost in a very loose sense. In this case, people start by meeting their basic needs—a place where they can spend their attention. Then, going up the arc, providing financial services for trading and saving, and a small part towards education or upskilling. I try to make Maslov's hierarchy of needs based on the above data.

At Web3 - we reverse this relationship. Most of us spend our time on Telegram, Discord, and Twitter. The market is a source of entertainment, but it comes at a huge economic cost.

Today's Web3 applications focus on financial applications or the speculative layer , and if the industry is to be relevant to the vast majority of people on the Internet, it needs to focus on the vast majority of people on the web today. For example, apps that don't require purchases, but can entertain or connect people.

That's not to say we're not working in that direction. Axie Infinity's surge in 2021 is partly due to the team spending two years building the largest Web3, mobile-first user base. More recently - Sweatcoin, a Web2 app with ±3-4 million DAU, has launched a token economy within its app.

Apps like Mirror, Coinvise, and OpenSea allow creators to forge stronger commercial connections with their users. But in almost all of these cases, we assume that users will participate in the transaction, and our focus should be on enabling passive participation. A user can benefit without actively trading or publishing, and there is a class of applications that may lead the shift.

This category is the game. They have rich digital assets, have the largest user base, are attractive to different groups of people, and have the lowest purchase requirements. Unlike most cryptocurrency apps today, games bring a community and entertainment experience to users.

Because of the overlap in user behavior between gamers and those involved in cryptocurrencies, it becomes very easy to educate users about wallets, conduct transactions, or interact with NFTs through games.

What is the future?

Today's Web3 is a community of tech bros at the height of their speculation explaining how groundbreaking it is to follow a small picture and then discover a wallet address.

But if it has to seep into the fabric of society, we need to think clearly about how people interact with technology. We need to build tools that change how humans think about why they should care about this technology.

Several companies are already working on this vision. For example, Bluejay is developing a stablecoin for emerging markets, and Goldfinch has issued more than $100 million in loans to SMEs around the world.

According to Crypto-art, the hype surrounding NFTs is well-founded, as it has helped nearly 900 artists earn over $100,000 and over 10,000 artists over $2,000 over the past year income.

So in some parts of the market, we're making meaningful changes -- but with mobile, it can be extended to everyone.

Our focus should be on making this transition from a messy, confusing Web3 that has users scrambling in different directions to a Web3 that is guided, curated, and useful. All of this is done to preserve the characteristics that cryptocurrencies originally had: decentralization and inclusiveness.