OKX – OKX Pool Hedging Service Business Rules

A. What is OKX Pool Hedging Service

The OKX Pool Hedging Service is an exposure hedging product tailored for OKX Pool users to secure yields in advance. After estimating the number of token one is able to mine in a certain period of time, a miner may secure the value of the token with this service by agreeing to sell “in advance” the to-be-mined tokens at the current price.

B.How to use OKX Pool Hedging Service

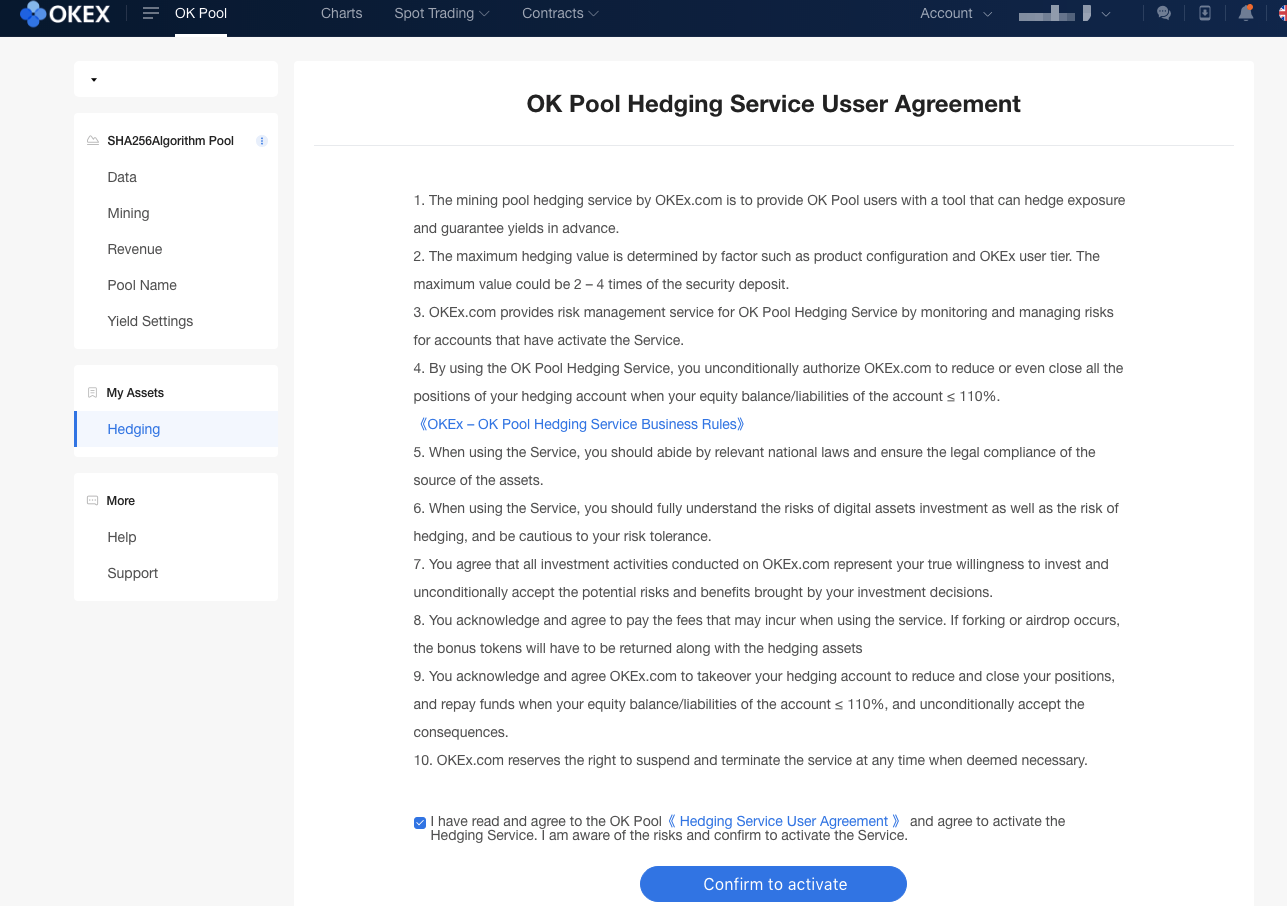

1. Agree to the OKX – OKX Pool Hedging Service User Service Agreement

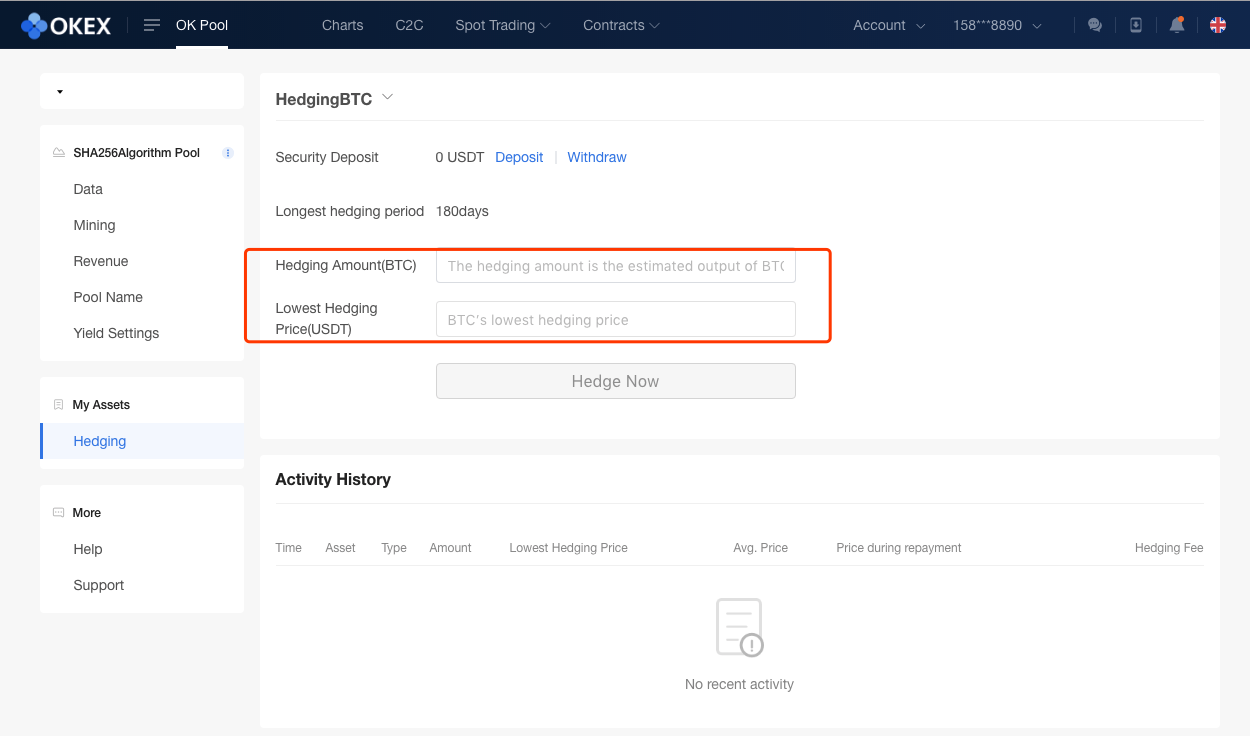

2. Set up your hedging parameter

- Enter the hedging amount and minimum hedging price

- Please take reference from the market price when setting your minimum hedging price. Otherwise, your hedging request may fail due to over-deviation in price.

3. Transfer in USDT as margin deposit

To use the service, you are required to transfer in USDT as a margin deposit. There is a minimum requirement for the deposit. The more the margin deposit, the safer your Hedging Account would be.

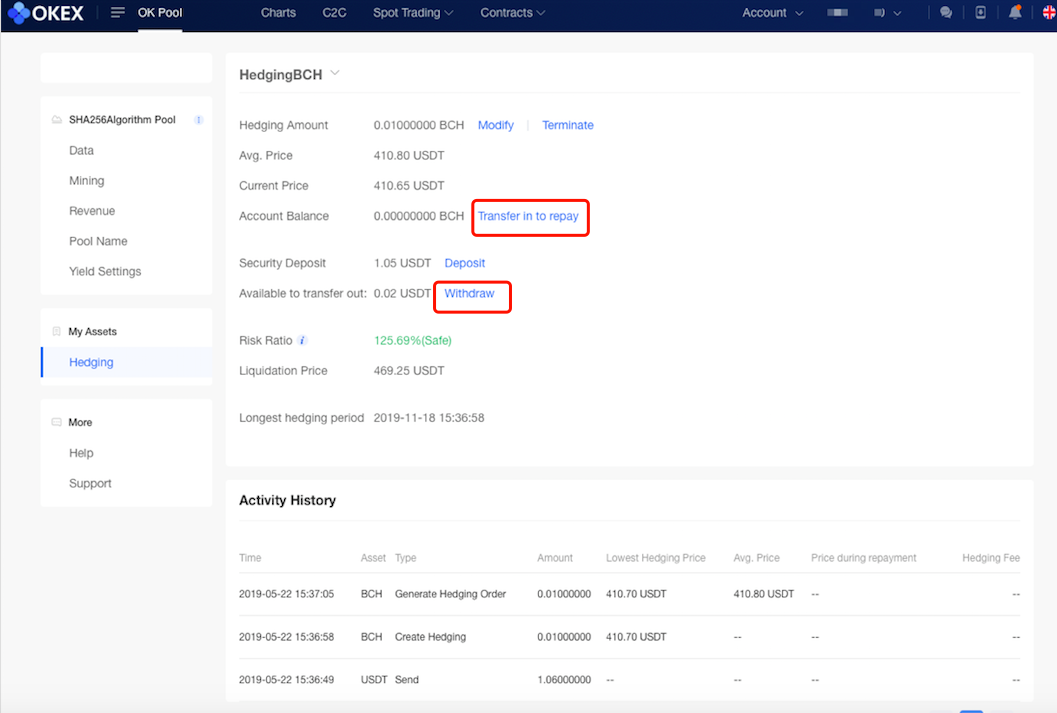

4. Repay hedged asset and transfer out yield

You may transfer in the hedged asset to repay the hedged amount. After repayment, the corresponding locked USDT amount will be unlocked for transfer-out. The available amount for transfer-out is also determined by the risk rate of your Hedging Account. Please refer to your account details for the actual available amount.

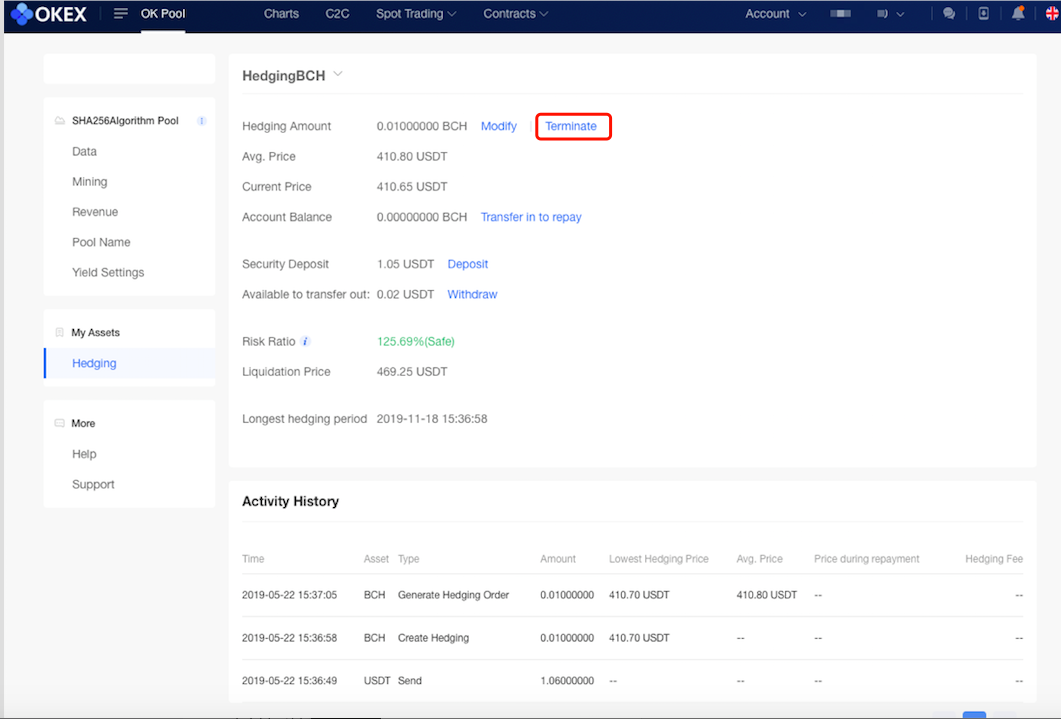

5. End hedging

You may end the Hedging Service anytime during the hedging period. After ending the service, you may transfer out all your assets in the Hedging Account.

- When you have repaid all the hedged assets by transfer-in, the service will end automatically.

- You may click “End Hedging” on the page to end the service. The system will then buy your hedged asset with USDT to end the Hedging Service. The system will buy-in at an optimal price for the quickest transaction, which may vary from the latest market price.

- When the maximum hedging period is reached, the system will end the service automatically.

For example:

John the miner can mine 1 Bitcoin (BTC) every day, but he is worried the price of Bitcoin will fall and he will suffer loss. To secure his return, he may use OKX Pool Hedging Service.

John can mine about 1 BTC per day, and in 180 days he can mine 180 BTC. Regardless of the change in hash rate, he can hedge 180 BTC. Given the current market price of 1 BTC is 5,000 USDT, he can set the minimum hedging price at 5,000 USDT and transfer in a certain amount of USDT as a margin deposit. By doing so, he can sell 180 BTC “in advance” at a minimum of 5,000 USDT each and get 5,000 * 180 = 900,000 USDT in return.

He may repay the Bitcoin he has mined afterward. Once he has repaid 180 BTC, he will receive the 900,000 USDT sum. If the BTC at the time of repayment is 4,000 USDT, he can secure the difference of (5,000 – 4,000) *180 = 180,000 USDT (excluding transaction fee and hedging fee).

A step-by-step guide to purchasing and selling crypto on OKX,

Step 1: Log in to your OKX account

Before you can start buying or selling cryptocurrency on OKX, you must first log in to your OKX account. If you do not yet have an account, click Sign up and complete the registration process.

Step 2: Select Buy/Sell

Once you have logged in to your OKX account, click Buy Crypto in the upper left-hand corner of the screen to get started.

Step 3: Select your purchasing method

The next step is to choose how you would like to buy or sell . There are two primary options on OKX: Express and P2P trade.

Finally, simply confirm your transaction details.

Sign up and log in with the App to claim your Mystery Box worth up to $10,000